Major Heading Subtopics

H1: Verified LC vs Irrevocable LC: Why Adding a Confirming Financial institution Could Save Your Upcoming Offer -

H2: Introduction to Letters of Credit score in International Trade - Worth of LCs

- Overview of Secure Payment Mechanisms

H2: What on earth is an Irrevocable Letter of Credit? - Definition

- Legal Binding Phrases

- Non-cancellation Clause

H2: What on earth is a Verified Letter of Credit history? - Definition

- Role from the Confirming Financial institution

- How Affirmation Will work

H2: Key Distinctions Involving Verified and Irrevocable LCs - Stability Ranges

- Chance Protection

- Occasion Obligations

H2: Why Irrevocable Doesn’t Always Suggest “Safe and sound†- Threats However Existing for Exporters

- Foreign Financial institution Credit rating Possibility

- Political and Forex Instability

H2: How Confirmation Adds an additional Layer of Security - Double Warranty Element

- Reliable Community Lender Involvement

- Enhanced Negotiation Placement

H2: Phase-by-Phase Technique of Including Confirmation to an LC - Requesting Confirmation

- Bank Evaluation

- Fees and costs

- Doc Move

H2: Expenses Associated with Verified LCs - Affirmation Costs

- Advisory and Negotiation Costs

- Cost-Gain Evaluation

H2: When Should Exporters Demand from customers a Confirmed LC? - Dealing with Mysterious Banking institutions

- Superior-Risk Nations

- Big-Price Contracts

H2: Verified LC vs Irrevocable LC – Comparative Table - Aspect-by-side Examination of attributes, threats, and Added benefits

H2: Genuine-Earth Case: Exporter Saved by Verified LC - Qualifications from the Deal

- Difficulties Confronted with Issuing Bank

- How Confirming Financial institution Saved the Payment

H2: Lawful Framework: UCP 600 and ICC Tips - Relevant Content

- Bank Duties

- Exporter Protections

H2: Popular Misconceptions About Confirmed LCs - “All Irrevocable LCs Are Protectedâ€

- “Affirmation is often Expensiveâ€

- “Neighborhood Bank Are unable to Affirmâ€

H2: Guidelines for Structuring a Safe LC with Confirmation - Obvious LC Clauses

- Deciding on the Right Confirming Bank

- Speaking with All Parties

H2: Potential Tendencies in LC Confirmations - Digital Confirmations

- eUCP Adoption

- Position of Fintech in Trade Finance

H2: Commonly Questioned Issues (FAQs) - Can any LC be verified?

- Who pays for that affirmation?

- Is often a verified LC normally irrevocable?

- What comes about if the issuing bank defaults?

- Can affirmation be taken off later on?

- Is confirmation typical in domestic trade?

H2: Summary - Recap of Critical Details

- Ultimate Recommendations for Exporters

Subsequent, I’ll begin creating the Search engine optimisation-optimized extended-form article using this framework.

Confirmed LC vs Irrevocable LC: Why Introducing a Confirming Financial more info institution Could Save Your Future Offer

Introduction to Letters of Credit in World Trade

Letters of Credit rating (LCs) are important applications in Worldwide trade, helping bridge the belief gap between exporters and importers. When two functions from various nations around the world enter into a trade arrangement, there’s always some volume of chance associated—non-payment, political instability, or default. LCs support mitigate these dangers by inserting a trusted third party—financial institutions—in the middle of the transaction.

Two frequent different types of LCs are classified as the Irrevocable LC and also the Confirmed LC. Though they may seem equivalent, their composition, danger publicity, and protecting features differ appreciably. Comprehending these variances could make or crack your future international deal.

Precisely what is an Irrevocable Letter of Credit rating?

An Irrevocable Letter of Credit history is a binding commitment from the issuing financial institution to pay the exporter (beneficiary) assuming that the conditions and terms are achieved. It can not be amended or cancelled with no consent of all get-togethers associated, rendering it extra responsible than the usual revocable LC.

But in this article’s the capture—“irrevocable†doesn’t necessarily mean “hazard-free.†If the issuing lender is inside of a fiscally unstable region or has inadequate creditworthiness, the exporter could nevertheless confront delayed or denied payments Regardless of complete compliance.

What is a Verified Letter of Credit rating?

A Confirmed LC is actually an irrevocable LC that includes a 2nd assure—from the confirming financial institution, normally located in the exporter’s place. This financial institution agrees to pay for the exporter In case the issuing bank fails to do so.

The confirming bank totally evaluations the LC and ensures that the conditions are apparent and enforceable. The moment verified, the exporter can be confident that payment is going to be produced, even though political unrest, currency limits, or lender insolvency protect against the original issuing financial institution from satisfying its assure.

Crucial Variations Concerning Confirmed and Irrevocable LCs

Element Irrevocable LC Verified LC

Modify or Cancellation Not authorized with out consent Same

Payment Assurance Only by issuing bank By issuing and confirming financial institutions

Risk Degree Average Lower

Chosen By Buyers Exporters

Safety in Unstable Areas Minimal Higher

Why Irrevocable Doesn’t Constantly Necessarily mean “Secureâ€

It’s a typical false impression that an irrevocable LC assures Harmless payment. Although the LC can’t be cancelled unilaterally, it doesn’t defend exporters from threats like:

Issuing lender default

Political upheaval or sanctions

Forex inconvertibility

Delays in doc managing

This is why several seasoned exporters insist on incorporating a confirming financial institution, especially when managing substantial-chance customers or unfamiliar money establishments.

How Affirmation Adds an Extra Layer of Security

Introducing affirmation can drastically lower exporter exposure by:

Supplying dual assurance: Even if the overseas financial institution fails, the neighborhood confirming bank assures payment.

Speeding up transactions: Confirming banks often launch funds quicker, improving hard cash stream.

Improving credit obtain: Confirmed LCs are considered as lower-danger, allowing exporters to lower price them without difficulty.

In addition, it gives the exporter far more negotiating electrical power and confidence to interact in international specials with stricter purchaser credit history terms.

Charlie Korsmo Then & Now!

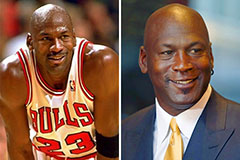

Charlie Korsmo Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!